Not known Details About G. Halsey Wickser, Loan Agent

Table of ContentsSome Known Facts About G. Halsey Wickser, Loan Agent.The 10-Minute Rule for G. Halsey Wickser, Loan AgentOur G. Halsey Wickser, Loan Agent PDFs3 Simple Techniques For G. Halsey Wickser, Loan AgentOur G. Halsey Wickser, Loan Agent Diaries

They might charge car loan origination charges, in advance costs, lending management costs, a yield-spread premium, or just a broker payment. When working with a home loan broker, you need to clarify what their fee structure is early on in the procedure so there are not a surprises on shutting day. A mortgage broker typically just makes money when a loan closes and the funds are released.The majority of brokers do not cost consumers anything up front and they are usually risk-free. You need to utilize a home loan broker if you desire to locate accessibility to home lendings that aren't readily promoted to you. If you don't have impressive credit history, if you have an unique borrowing circumstance like possessing your very own service, or if you simply aren't seeing mortgages that will certainly benefit you, after that a broker may be able to obtain you access to lendings that will be helpful to you.

Home mortgage brokers might additionally be able to aid loan applicants receive a lower interest rate than a lot of the business car loans use. Do you require a home mortgage broker? Well, dealing with one can save a borrower time and initiative during the application procedure, and potentially a great deal of money over the life of the car loan.

Top Guidelines Of G. Halsey Wickser, Loan Agent

:max_bytes(150000):strip_icc()/dotdash-090915-mortgage-broker-vs-direct-lenders-which-best-Final-c7e52f06ff4f41bca0744429ee1838e3.jpg)

A specialist home mortgage broker originates, bargains, and refines property and commercial home loan in support of the customer. Below is a 6 point guide to the solutions you should be used and the expectations you should have of a qualified home loan broker: A home mortgage broker provides a vast range of home loan from a variety of different lenders.

A mortgage broker represents your rate of interests instead of the rate of interests of a loan provider. They should act not only as your agent, however as a knowledgeable professional and trouble solver - california mortgage brokers. With accessibility to a variety of home mortgage products, a broker has the ability to supply you the best value in regards to rates of interest, settlement amounts, and car loan products

Several situations demand greater than the straightforward use a 30 year, 15 year, or adjustable rate home mortgage (ARM), so ingenious mortgage approaches and sophisticated solutions are the benefit of functioning with a seasoned home mortgage broker. A home loan broker browses the customer through any kind of circumstance, handling the procedure and smoothing any bumps in the roadway along the means.

The Facts About G. Halsey Wickser, Loan Agent Uncovered

Debtors who locate they need larger lendings than their financial institution will authorize also advantage from a broker's understanding and capacity to successfully obtain funding. With a home loan broker, you just need one application, as opposed to completing forms for each private lender. Your mortgage broker can provide a formal contrast of any kind of fundings suggested, directing you to the info that accurately depicts cost differences, with existing prices, points, and closing costs for each loan showed.

A trusted mortgage broker will disclose exactly how they are paid for their solutions, in addition to detail the complete expenses for the financing. Personalized solution is the setting apart factor when choosing a home loan broker. You ought to anticipate your home mortgage broker to help smooth the way, be available to you, and suggest you throughout the closing process.

The trip from dreaming concerning a brand-new home to actually owning one might be full of challenges for you, specifically when it (https://macro.market/company/g-halsey-wickser-loan-agent) concerns safeguarding a mortgage in Dubai. If you have actually been assuming that going straight to your bank is the most effective path, you could be missing out on a simpler and potentially more valuable option: collaborating with a home loans broker.

6 Easy Facts About G. Halsey Wickser, Loan Agent Explained

One of the considerable benefits of utilizing a home mortgage professional is the specialist monetary advice and important insurance coverage support you receive. Home mortgage professionals have a deep understanding of the different monetary products and can help you pick the best home loan insurance policy. They make sure that you are sufficiently covered and give guidance tailored to your monetary circumstance and lasting objectives.

This process can be daunting and time-consuming for you. A home loan brokers take this burden off your shoulders by managing all the paperwork and application procedures. They understand precisely what is needed and guarantee that every little thing is completed accurately and in a timely manner, lowering the risk of hold-ups and mistakes. Time is money, and a mortgage financing broker can save you both.

This indicates you have a far better chance of finding a mortgage in the UAE that perfectly suits your requirements, consisting of specialized products that could not be available through standard financial networks. Browsing the mortgage market can be confusing, particularly with the myriad of products available. An offers professional assistance, assisting you comprehend the benefits and drawbacks of each alternative.

5 Easy Facts About G. Halsey Wickser, Loan Agent Shown

This professional suggestions is vital in protecting a mortgage that aligns with your economic objectives. Mortgage advisors have developed connections with several loan providers, offering them considerable negotiating power.

Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Michael C. Maronna Then & Now!

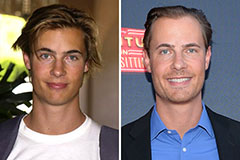

Michael C. Maronna Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!